iowa inheritance tax rate

How much is the inheritance tax in Iowa. Adopted and Filed Rules.

60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows.

. 4 - 12. 2 days agoOnly six US. For example while Iowas inheritance tax hurts its tax competitiveness that measure will improve once the tax is fully phased out in 2025.

For persons dying in the year 2023 the Iowa inheritance tax will be reduced by sixty percent. 2022 the effective tax rates listed in Iowa Code section 450101-4 are reduced by 20. Learn About Sales.

The legislation also removes revenue triggers implemented in the 2018 tax reform law to further drop the income tax rates on January 1 2023 with the top rate dropping from 853. The estate would pay 50000 5 in estate taxes. States have inheritance taxes and oneIowais in the process of phasing out their inheritance tax.

States With Inheritance Taxes. If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero. 2 to 16.

A summary of the different categories is as follows. For more information on exempt beneficiaries check out Iowa Inheritance Tax Law Explained. Learn About Property Tax.

These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie. There are a number of categories of inheritor for the inheritance tax but only two are relevant for individuals. DES MOINES Iowa The Iowa Senate on Wednesday passed 46 to 0 SF 576 a bill that repeals Iowas inheritance tax and state qualified use inheritance tax.

Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to. Tax Rate D and Tax Rate E beneficiaries are for various types of organizations. On May 19th 2021 the Iowa Legislature similarly passed SF.

Read more about Inheritance Deferral of Tax 60-038. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance. Iowa County Names and Numbers 76.

Aunts uncles cousins nieces and nephews of the decedent. Amounts up to 12500 are taxed at 5. Iowa inheritance tax rates If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to 8 on the value of inheritances worth more than 150000.

Here are the six states with inheritance taxes. All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site. This is for siblings half-siblings and children-in-law.

Penalties can only be waived under limited. 100001 plus has an Iowa inheritance tax rate of 15. Law.

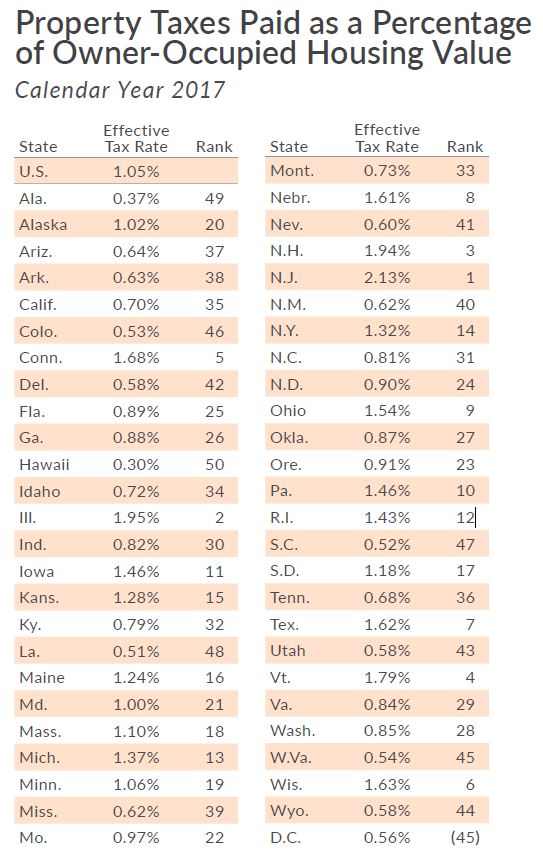

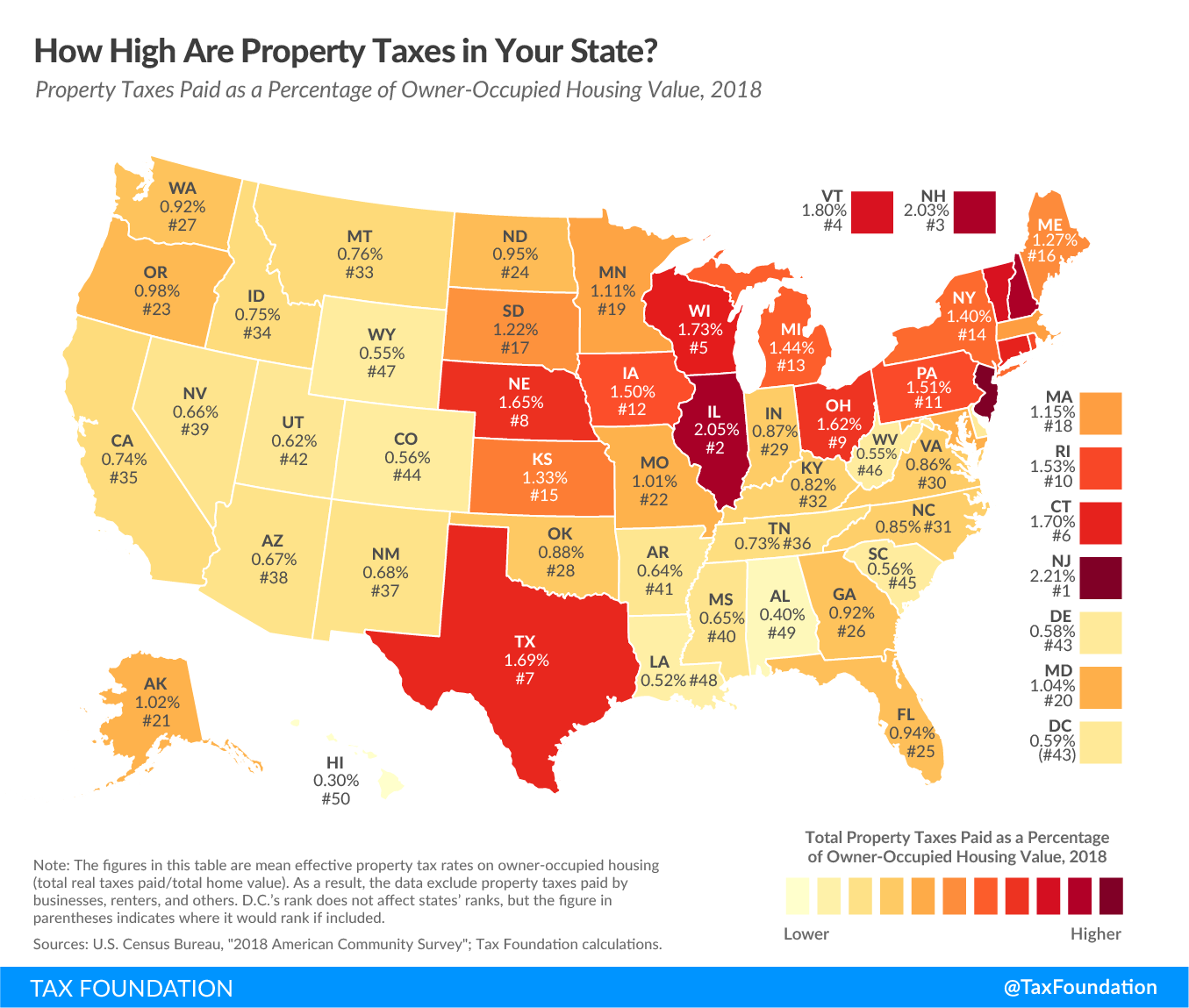

60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. It has an inheritance tax with a top tax rate of 18. Despite this Iowa has an above-average effective property tax rate on owner-occupied housing and above-average property tax collections per capita which hurts Iowas score on the property tax.

These taxes are imposed on any person who becomes beneficially entitled to any property or interest by any method of transfer. 0-50K has an Iowa inheritance tax rate of 10. Even if no tax is.

What is Iowa inheritance tax. The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be.

You would pay 95000 10 in inheritance taxes. That is worse than Iowas top inheritance tax rate of 15. The rate is determined by the amount of the inheritance received and range from anywhere between 5 and 15.

1 - 18 with the top tax rate dropping to 15 in 2023. File a W-2 or 1099. For persons dying on or after January 1 2025 the Iowa inheritance tax is repealed.

While there is no state estate tax in Iowa. For a brother or sister including half-brothers and half-sisters son-in-law or daughter-in-law the following tax rates apply. If the net value of the decedents estate is less than 25000 then no tax is applied.

Iowa Inheritance Tax Rates. If instead you are a sibling or other non-linear ancestor then you are subject to pay an inheritance tax on your portion. The effective tax rates will be reduced an additional 20 for each of the following three years.

In 2013 the Indiana legislature repealed their inheritance tax completely. There are also Tax Rate F beneficiaries which are unknown heirs and their tax rate is 5. Inheritance Deferral of Tax 60-038.

The following Inheritance Tax rates will apply to a decedents beneficiary who is a. Iowa Inheritance and Gift Tax. If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero.

Under the former law which will be in effect until December 31 2024. The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person. Even if no tax is.

Probate Form for use by Iowa probate attorneys only. Tax Credits. 50001-100K has an Iowa inheritance tax rate of 12.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. For persons dying in the year 2024 the Iowa inheritance tax will be reduced by eighty percent.

For deaths occurring on or after January 1 2025 no inheritance tax will be imposed. A surviving spouse decedents lineal ascendants descendants and stepchildren are exempt from the inheritance tax. Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary.

The rate ranges from 5 to 10 based on the size of. Browse them all here. A bigger difference between the two states is how the exemptions to the tax work.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. Inheritance Tax Rates Schedule.

Up to 25 cash back How much inheritance tax each beneficiary owes depends on the beneficiarys relationship to the deceased as well as how much the beneficiary inherited. Administrators executors referees and trustees of taxable estate transfers may also be liable for. Read more about Inheritance Tax Rates Schedule.

You would receive 950000. Iowa Inheritance Tax Rates. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

Skip to main content.

Rv Living How To Make It Without A House Infographic Map Real Estate Infographic Estate Tax

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Iowa Inheritance Tax Law Explained

Florida Estate Tax Rules On Estate Inheritance Taxes

Image Result For U S National Map Of Mosquito Population How To Start Running Mosquito Magnet Mosquito

Spanish Citizens And Workers Have Access To Free Healthcare In Spain But What About Expats Here S What You Need Healthcare System Health Care Healthcare Plan

Iowa S Repeal To Leave Nebraska With Region S Only Inheritance Tax

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

Recent Changes To Iowa Estate Tax 2022

Image Result For U S National Map Of Mosquito Population How To Start Running Mosquito Magnet Mosquito

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

Estate And Inheritance Tax Iowa Landowner Options

Iowa S High Property Taxes Iowans For Tax Relief

Image Result For U S National Map Of Mosquito Population How To Start Running Mosquito Magnet Mosquito